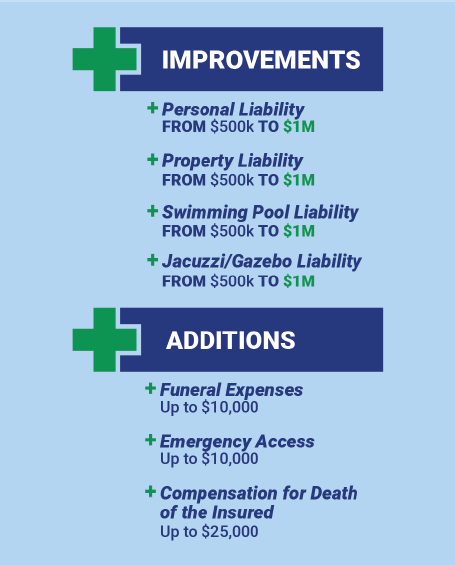

IMPROVEMENTS & ADDITIONS TO YOUR COVER!

We are happy to report the following improvements and additions to your FCB

Homeowners Policy at your upcoming renewal:

It is important you disclose any information in writing on any changes or

developments in the risk profile of subject t insured that may influence the judgment of

a prudent insurer in fixing or assessing the premium or accepting the risk, failure to do

this may result in your policy being voided so we strongly advise you treat with the

requirement of disclosure seriously on this and every renewal.

PLEASE COMPLETE AND RETURN YOUR KNOW YOUR CUSTOMER FORM

Pursuant to the Financial Obligations Regulations 2010 and the Proceeds of Crime

Act (2000), AML/CTF Regulations mandate Brokers to conduct Due Diligence on their

customers by obtaining the requisite Know Your Customer (KYC).

DOWNLOAD & FILL PDF FORM

Please note that it is imperative you notify us immediately upon the happenings of any

loss or development which may give rise to a claim. Any delay in notification can

result in repudiation of a claim by Insurers. In a liability situation, you must neither

give admission thereof nor undertaking to settle or make any payment in respect of

any claim presented to you in connection therewith.

It is your responsibility to read your insurance documents and familiarize yourself with the policy coverage,

terms, conditions, and deductibles. Please take a moment to go over it. Should you require an

explanation of your coverage, feel free to contact us at NGL

It is essential to check the attached/enclosed broker slips and documents of Insurance to ensure that

the information is accurate and in accordance with your requirements. If it is not, immediately notify us

at NGL at for this to be corrected.

ARE YOU OVER THE AGE OF 60?

Once all persons named on the policy are over 60 years of age, they will not be

subject to the 6% Government Tax. Two valid forms of government-issued

identification from each person are required to enable us to exempt you from this Tax.

Please note this exemption does not apply to properties held in company names.

We advise that Policyholders declare separate values where possible. Buildings, stock in trade, tenants

improvements, values per location etc. This exercise may be beneficial in determining the adequacy of

your sum insured and applying excesses in the event of a loss.

A deductible/excess is the amount you are responsible for in the event of a loss as

stated on your policy.

EXAMPLE

Agreed Loss $100,000.00

Policy Excess $ 5,000.00

Claim Settlement $ 95,000.00

Simply put, insurers will not entertain claims below the stated policy deductibles.

CHANGE IN OCCUPANCY OF THE POLICY

Policyholders must advise us if the property is no longer occupied as a private

dwelling, as this affects the policy cover. Informing us will ensure we secure the

necessary cover on your behalf.

If you would like to discuss any matter with respect to your policy please contact any

member of our Personal Lines Division for assistance.

Telephone: +1 (868) 62-COVER, +1 (868) 622-0007

Whatsapp - +1 (868) 723-0472